2 min read

4 Reasons Digital Signage is a Must-Have on Any 2021 Budget List

Megan Urlacher

:

Updated on July 12, 2021

Megan Urlacher

:

Updated on July 12, 2021

With the current pandemic on our hands, it’s safe to say budgets will be tight in 2021. Financial executives will need to spend wisely and defend their decisions on what makes the cut. Digital Signage may not be on the top of your budget list, but it should be. Why? Because it can cost effectively help solve a lot of the challenge's bankers are facing in today’s uncertain times.

Create a safe and positive branch experience in response to COVID-19

Brand perception is being greatly affected by the crisis, and the last thing you want is to appear tone-deaf or uncaring. In a recent study of 6000 consumers, 58% say how businesses have responded to COVID-19 has impacted their view of the brand.

Easily display prominent safety and community messaging with digital signage. Engaging messaging can help clients feel safer, help them understand what you have done in response to the pandemic, and show your community support.

The best part is consistent messaging can be pushed out to every screen in your branch network with just a few clicks. A heck of a lot easier than trying to send printed signage to each branch and having it hung up, or worse having each branch create their own.

|

|

|

|

More effectively onboard to mobile

Onboarding your clients to mobile and digital channels is more important than ever before. Yet, the average adoption rate for Remote Deposits has stayed stagnant at just 29% for the last 5 years.

While many think mobile tools are a “build it and they will come” service, non-tech savvy consumers but don’t always understand how to use it or why. One of the biggest drivers of a successful mobile onboarding strategy includes hands-on learning tools for clients, and an engaged staff who are comfortable using the tools themselves. Discovery Bars with digital signage tablets and engaging tutorials is the most effective way to increase adoption by 20% year over year on average.

Use the Drive-Up to help clients discover how you can help them through life’s financial journey

If other industries and the current banking trends are any indication, the resurgence of drive-ups during and after this pandemic is likely. Don’t waste a valuable opportunity to help your clients discover all the products and services you offer that can help them through life’s financial journey. Drive-ups are a perfect place to add digital signage that has a captive audience.

Drive advisory connections while remote

Another big market need that is proving more difficult now than previously, is figuring out how to grow wallet share and still make connections between clients and staff when branch traffic is down and folks aren’t leaving the house as much.

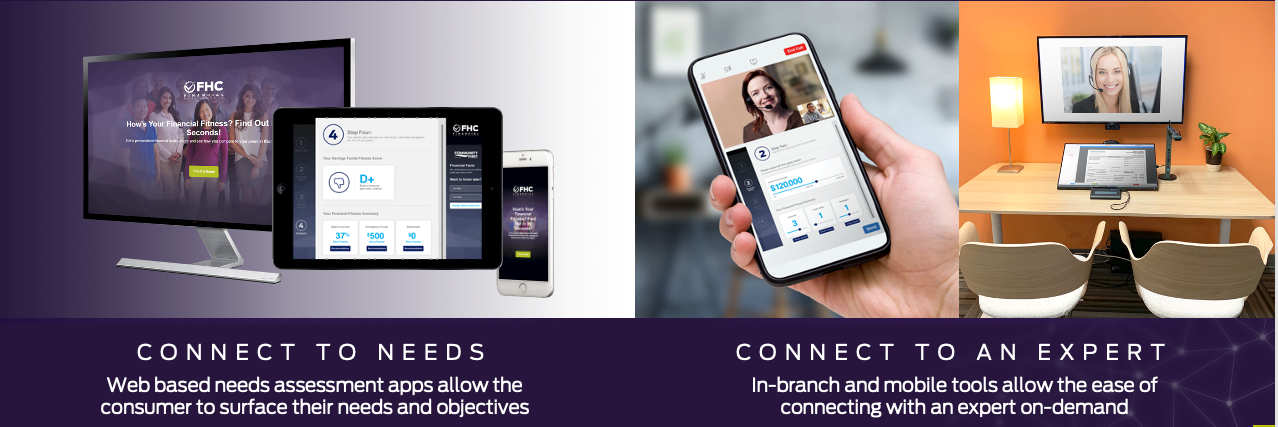

Yet, at the same time, consumers need financial advice and help more now than ever before. And truly banks and credit unions are best positioned to help meet that need. Financial Healthcheck (FHC), combined with video banking, and remote expert technology is a solution perfectly aligned to helping both consumers and financial institutions make the connection.

FHC is a web-based quiz that consumers can take from the safety of their own home in 90 seconds, that shows them how they are doing financially and how they compare to their peers. If they aren’t doing as well as they hoped, this can help drive demand for financial products. Plus a video banking integration makes it easy for a consumer to connect to a banker through their phone of video conference room in a branch.

-1.png)

-4.png)