Adding Universal Associates to your branch NETWORK can increase time and cost savings while also creating more meaningful client and staff interactions.

As we move into the digital age, it’s pretty easy to notice that retail banking is evolving similar to other consumer-facing businesses. There are apps for transacting from just about anywhere, increased self-service options, and customized perks built to draw consumer interest. On top of that, when clients visit a physical location, they tend to expect more personalized, interactive service.

This encompassing change likely explains the drop in branch traffic and steady decline of the bank teller job, a role that peaked in 2010 when over 600,000 U.S. wage earners served behind teller lines. By 2022, that number was just over 352,000 according to the Bureau of Labor Statistics and is projected to continue dropping at a rate of 12% through 2030.

Since retail banking is indeed evolving, what should your financial institution do about front-line customer service? Should you implement more advisory-based roles at your branch locations and reduce or eliminate tellers? What does a Universal Associate actually do, who can be one, and how do you train them?

These are questions we will answer as you continue reading. In fact, no matter what stage you’re at in exploring the Universal Associate model, DBSI is ready to assist you with the decision-making process. And if you choose to add this new role to your branch network, we even have a Universal Associate workshop that will help your employees launch their new careers successfully and adjust to the changeover.

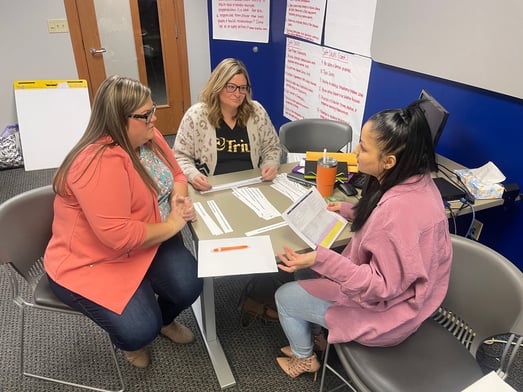

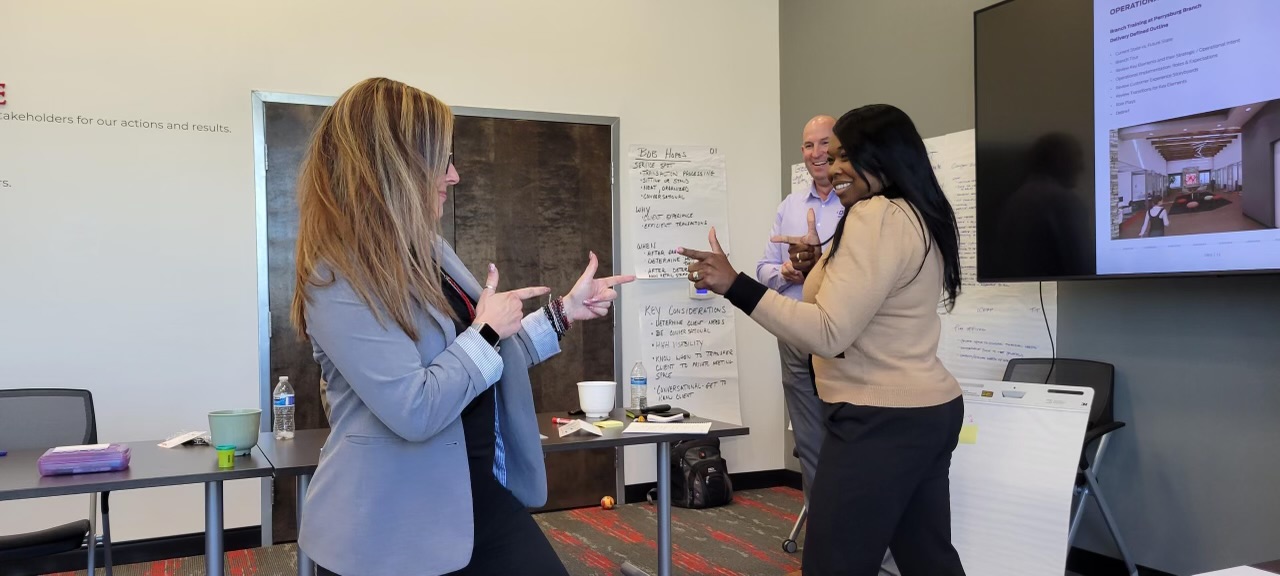

A DBSI Universal Associate workshop IN ACTION

What’s Behind the Universal Associate Role?

As the word “universal” implies, Universal Associates complete a wide variety of tasks inside the retail branch. They have been called superheroes in a hypothetical sense—but whether they’ve got cosmic powers or not—these hybrid roles combine the knowledge and skill levels of a teller, personal banker, and customer service representative in order to provide exemplary service to all clients.

Also known as Universal Bankers, Universal Tellers, and Member Service Representatives (MSRs), Universal Associates are growing in popularity each year as one in three financial institutions are now operating with the Universal Associate Model according to a 2022 Tech Trends Survey by Kinective.

What duties do Universal Associates actually have? Essentially, Universal Associates work with clients in an advisory manner to help them complete transactions, manage cash, savings, and investment accounts, service their loans, and explore banking products and services. Universal Associates differ significantly from traditional bank tellers, as the breadth of their responsibilities goes well beyond the transactional level.

Staff Members in Universal Associate roles will often:

- Cross-sell products and services

- Open and provide service for personal, business, and investment accounts

- Provide financial guidance

- Complete basic banking transactions

- Administrate branch marketing campaigns and advertising efforts

- Support back-office operations

- Provide service and support for mortgage loans

- Administrate community-based fundraisers and service initiatives

- Issue and process consumer, auto, and personal loans

Compensation and Career Advancement: Universal Associates vs. Tellers

Although both Universal Associates and tellers play significant roles in supporting clients, the responsibilities and skill sets of these roles are obviously much different from one another—therefore affecting compensation and career advancement potential.

Regarding career advancement, a teller with enough experience can sometimes advance within their financial institution to become a head teller. However, if they want to move into another position, they will usually need to receive additional training in account management, lending, and advisory banking practices in order to qualify for an advanced banking role.

An employee working as a Universal Associate is usually trained in relationship, loan, and account management along with sales and marketing. This combination of skill sets gives Universal Associates opportunities to easily cross into supervisory branch management or lending work as their careers advance.

Download our full guide

on The Universal Associate Model!

Becoming a Universal Associate

If your financial institution is considering adopting the Universal Associate model, one of the first questions you probably have is whether you can train existing employees into these roles or if you need to hire new employees. There are many factors involved in each employment decision, but if you have staff with adequate retail and consultative experience who are good at meeting client needs, you can likely promote and train from within your organization.

Additional skills that benefit the Universal Associate role include:

- Proficiency using Teller Cash Recyclers (TCRs) and Teller Cash Dispensers

- Ability to cross-sell products and services

- Direct marketing, social media marketing, email marketing

- Customer relationship management

From an organization-level perspective, adopting a Universal Associate model is usually part of a more transformative shift in your branch infrastructure. This includes updating branch floor plans to accommodate advisory-level banking roles and adding equipment like TCRs, interactive screens and kiosks, digital signage, and more. While this may raise concerns related to the overall costs of adopting the Universal Associate model, it’s important to note that the technology and jobs implemented will typically offset the inefficiencies created by declining branch traffic.

Upsides of Adopting the Universal Associate Model

After years of assisting financial institutions in creating more modern, advisory-level banking environments with our design-build solutions, we have seen the Universal Associate model bring a host of upsides such as:

Better client experiences. Because Universal Associates are trained to manage most in-branch transactions, clients don’t get handed off to other employees or spend time waiting in line for service.

Lower FTE costs. With the addition of self-service technology and the efficiency of Universal Associates, it’s possible to reduce FTE costs by the equivalent of at least two full-time employees per branch when the Universal Associate model is implemented.

Improved career options. Historically, turnover of teller staff at retail branches has been fairly high, but the Universal Associate role offers better employee experiences and compensation, leading to more rewarding work and higher employee retention.

Downsides of Adopting the Universal Associate Model

While we appreciate poring over the benefits of the Universal Associate model, we also know it’s necessary to share the challenges financial institutions can face when adopting this model, including:

Employee skepticism. Change always tends to have a way of evoking fear amongst employees. They may be concerned about getting fired or that someone else will take over their job duties. Involving all employees in your Universal Associate training and sharing overall corporate goals is an excellent way to assure employees that they are valuable members of your team and that the change in corporate structure will benefit everyone.

Longer training time. Besides the technology that often must be implemented when the Universal Associate model is adopted, it can take months to get employees trained and versed at new scripts. To assist in this process, DBSI offers a program called Delivery Defined, which is a tool to help train your team on new technology and work models plus provide ongoing support for your branch. You can also opt in to one of DBSI’s Universal Associate workshops to get your team up and running with confidence.

Next Steps

Once you’re ready to transform your financial institution and implement the Universal Associate model, DBSI can assist you in developing a plan that works with your timeline and your budget. For more information about Universal Associates, please download our UA resource library or contact us for a no-obligation consultation.

Together, let's bring the vision for your future to life!

Through DBSI’s carefully curated professional service programs, we can help shift your staff’s culture, processes, job descriptions, and so much more.

Janice Bourbon

Janice Bourbon

-1.png)

-4.png)