2 min read

Branch Movie Monsters: Facing Your Branch Transformation Fears!

Bruce Allen Eastwood : Updated on February 11, 2021

If some paranoia is creeping into your brain about the future, you’re not alone. Nearly 9 out of 10 financial execs are unclear about their future branch plans, even though they feel that transformation is imperative.

In horror-film fashion, we’re shedding light on some common frights, so you can see why there’s no need to fear a Branch Transformation.

Grab your candy, popcorn and flashlight, because it’s time to face your Branch Transformation fears!

Fear: A Beastly Budget

The Budget Beast is coming, with an unclear all-in cost, unexpected expenses, and shifting estimates. What can save your transformation!?!

Face the Budget Beast with DBSI and our Smart Budget Tool to calculate an accurate estimate of your all-in cost. With more than 500 branch builds and remodels under our belts, we know every aspect of what goes into a branch. Line by line, we show you what you can expect things to cost at various levels, giving you total control and transparency.

Fear: Invisible Marketing

Unsuspecting clients go about their business at the branch, never knowing or seeing what products and services are available to them. The invisible marketing goes undetected, wreaking havoc on your sales efforts!

Unsuspecting clients go about their business at the branch, never knowing or seeing what products and services are available to them. The invisible marketing goes undetected, wreaking havoc on your sales efforts!

The average U.S. consumer has about 8-9 banking products but only 3-4 are with their primary financial institution. Show them more of what you offer with an effective Digital Signage strategy.

A majority of surveyed financial institutions in our 2016 Digital Signage Benchmarking Survey, said Digital Signage and interactive touchscreens improved their sales efforts, with 47 percent respondents attributing an 11-30 percent sales increase to it!

Fear: Terrible Technology!

Over the years you’ve patched together different, outdated technologies and now you’ve created a monster, terrorizing the branch with inefficiencies!

Over the years you’ve patched together different, outdated technologies and now you’ve created a monster, terrorizing the branch with inefficiencies!

To transform your technology from Frankenstein to fantastic, we offer a number of solutions from our sister company, CFM:

- CFM S4 offers real-time integration of your core and all your recyclers/dispensers.

- NORM keeps everything running, even if the network isn’t.

- iQ provides real-time analytics of your recyclers/dispensers.

- RTA is a line-busting technology that opens doors to Universal Asscociates by giving staff a secure way to process any transaction, anywhere in the branch utilizing cash recyclers.

Fear: Zombie Associates

Afraid your staff might not adjust and succeed in transforming your clients branch experience? Don’t let them become one of the Working Dead!

Afraid your staff might not adjust and succeed in transforming your clients branch experience? Don’t let them become one of the Working Dead!

Arm your associates with Delivery Defined to ensure the effects of your Branch Transformation are realized. This unique training program puts your new tools and strategy to work, giving your staff the information and practice they need to deliver a new branch experience.

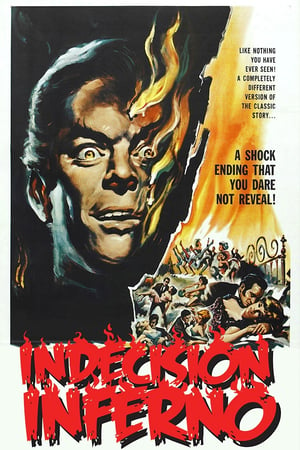

Fear: Indecision Inferno

The challenge of Branch Transformation is enough to make any sane person begin to feel a bit unhinged. Don’t succumb to the indecision inferno!

The challenge of Branch Transformation is enough to make any sane person begin to feel a bit unhinged. Don’t succumb to the indecision inferno!

Over 400 banks and credit unions have started their Branch Transformation journey at our Ideation Center, to explore new branch designs and technology first-hand, or with a Jump Start Session at their branch to gain clarity and start their action plan.

As part of our comprehensive Branch Transformation services, we also use Discovery Survey, branch visits and executive interviews to create an Executive Summary that sets the stage for a successful transformation.

Have No Fear!

We've helped hundreds of financial institutions complete their goals with the strategies above. Contact us if you're ready to face your branch fears and tackle Branch Transformation.

-1.png)

-4.png)