3 min read

4 Must-Have Essentials to Create Your Branch Transformation Strategy

Sean Hughes

:

Updated on September 16, 2020

Sean Hughes

:

Updated on September 16, 2020

“Give me six hours to chop down a tree and I will spend the first four sharpening the axe.” – Abraham Lincoln

As some of the world's greatest minds know, strategy is everything. Taking the steps to prepare yourself and your financial institution for success is more important than the execution itself. Everything you do to transform should have a purpose and reason.

Of course, the hard part is figuring out what is a solid strategy that puts your investment to good use and takes your branch experience to the next level. But with the first quarter of 2016 coming to an end, how much progress have you made on your branch improvement plans and strategy?

If you're like most FIs, you're probably still struggling to figure out what initiatives are right for your branch network... and for good reason. Comprehending what actually delivers results and what will work for you is an enormous amount of information and choices to digest.

But it doesn't have to be that way. There's got to be a solution to simplify the complex (if people can perform brain surgery, we're pretty sure we can figure out how to transform branch networks!).

The secret to anything complex is developing a simple process that clears out the clutter and unites tangible initiatives into a plan of action. It's possible. To help you get started, here's an inside look at how the pros (ahem...DBSI) tackle this elusive task of developing and executing successful branch transformation strategies.

Step 1. Understanding You

The first step for developing a branch transformation strategy is understanding your financial institution as a whole. To do this, you must perform an in-depth inventory of where you stand today. More specifically, you must answer:

- What makes you unique or different?

- What is the client experience like in the branch now?

- What is getting in the way of optimal service and sales?

- What are you trying to achieve with a transformation?

- Who does it right?

This isn't just an exercise you can perform with one or two people within your financial institution. To get a holistic picture, you need to ask a wide range of folks at different levels–the executive team, retail folks, and even a few branch level staff.

Uncovering these simple things is a fundamental success factor to branch transformation. And it's a must to differentiate yourself. For us, we use an in-depth Discovery Survey, along with branch visits and executive interviews to collect all of the data we need to truly get to the core of a financial institution.

As stated in a 2015 Accenture survey, U.S. consumers want a more personalized retail experience. There’s no cookie-cutter, one-size-fits-all, templated branch transformation solution. You’re unique. Your challenges are different. Your needs are diverse. You must understand you first, in order to create the right foundation to improve upon.

Step 2. Research Your Market and Your Competitors

Just as your FI is individual, so is your market. It’s important to learn market trends, statistics, facts and figures. This gives you an edge and a connection to consumers your competition might not obtain nor even know about.

Speaking of your competition, you’ll want to know what they’re up to—both good and bad. As an Inc.com article highlighted, “you’ll want to go beyond the Google search.” It’s important to understand competitor failures and successes. You want to know what will work for you and what won’t. The Inc.com article also suggested hiring a 3rd party company to do the research for you—we’ll explain later why this isn't necessary.

Step 3. Gain Executive Alignment

Once you've taken the time to assess your financial institution, it's important to compile what you've learned into a reviewable report. Why? So you can get your entire executive team rowing towards the same goals.

Many times, this is where financial institutions get stuck. Too many people have conflicting opinions, so nothing get done. In our experience, putting everything together in a concise summary makes it much easier to evaluate goals and objectives and find common ground.

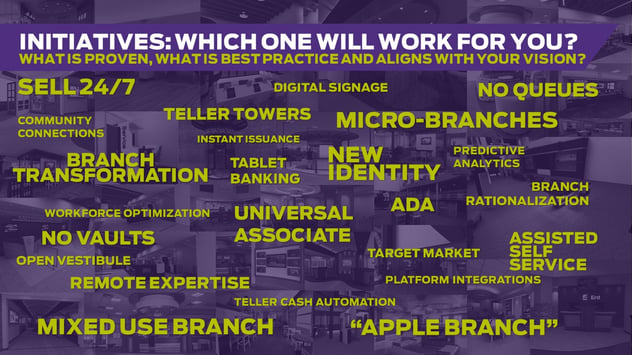

Step 4. Determine Initiatives to Focus On

As too many of FIs know, trying to implement all the initiatives out there just doesn't make sense. And with so many out there, deciding on the right ones can be tricky.

Once you are armed with an understanding of who you are today, what challenges you are facing, and where you want to go, matching the right solutions and initiatives suddenly becomes easy. It's no longer wondering what to choose, but merely evaluating initiaitves based on your new-found criteria.

And that's where magic starts to happen. With a strong list of objectives and initiatives, you've got the foundation of a strategy, and ready to start to move to the fun part of actually designing the look and feel of your branches.

DBSI runs through these 4 steps with you

Remember in Step 2. Research Your Market and Your Competitors when we said, “we’ll explain later?” Well, here's why: DBSI will research your financial institution, your market, your competitors, and your branches to develop an Executive Summary—which is the final sharpening of your Lincoln-esque axe to cut down the tree of your past network and use the wood to build the lasting future of your new branch network. But, it all begins with a visit to DBSI's Ideation Center.

During your Ideation Center visit, you and your team will discover exactly what you’re looking for when it comes to the future of your financial institution. You’ll begin to discover who you are and what your needs are. You'll discover technology some of the most successful banks and credit unions are deploying to draw more consumers in while building brand loyalty. You'll figure out how to save money and boost ROI. And bonus, lunch and drinks are on us! Click below to get started with building your strategy:

-1.png)

-4.png)