As a company that’s converted and rebranded thousands of branch locations following a merger or acquisition, we’ve seen our fair share of how financial executives can get the process right and wrong. The negotiations and legalese leading up to the M&A are certainly stressful, but the branch rebranding process after the deal is inked can be just as much, if not even more, painstaking.

Lining everything up and getting every last rollout detail right truly takes a village. Or a partnership with a comprehensive firm that is your village with all the capabilities and turn-key services under one roof (...like DBSI 😀).

Here’s a quick look at a few merger and acquisition projects from our playbook that went amazingly well, the stories behind them, and how they were executed flawlessly.

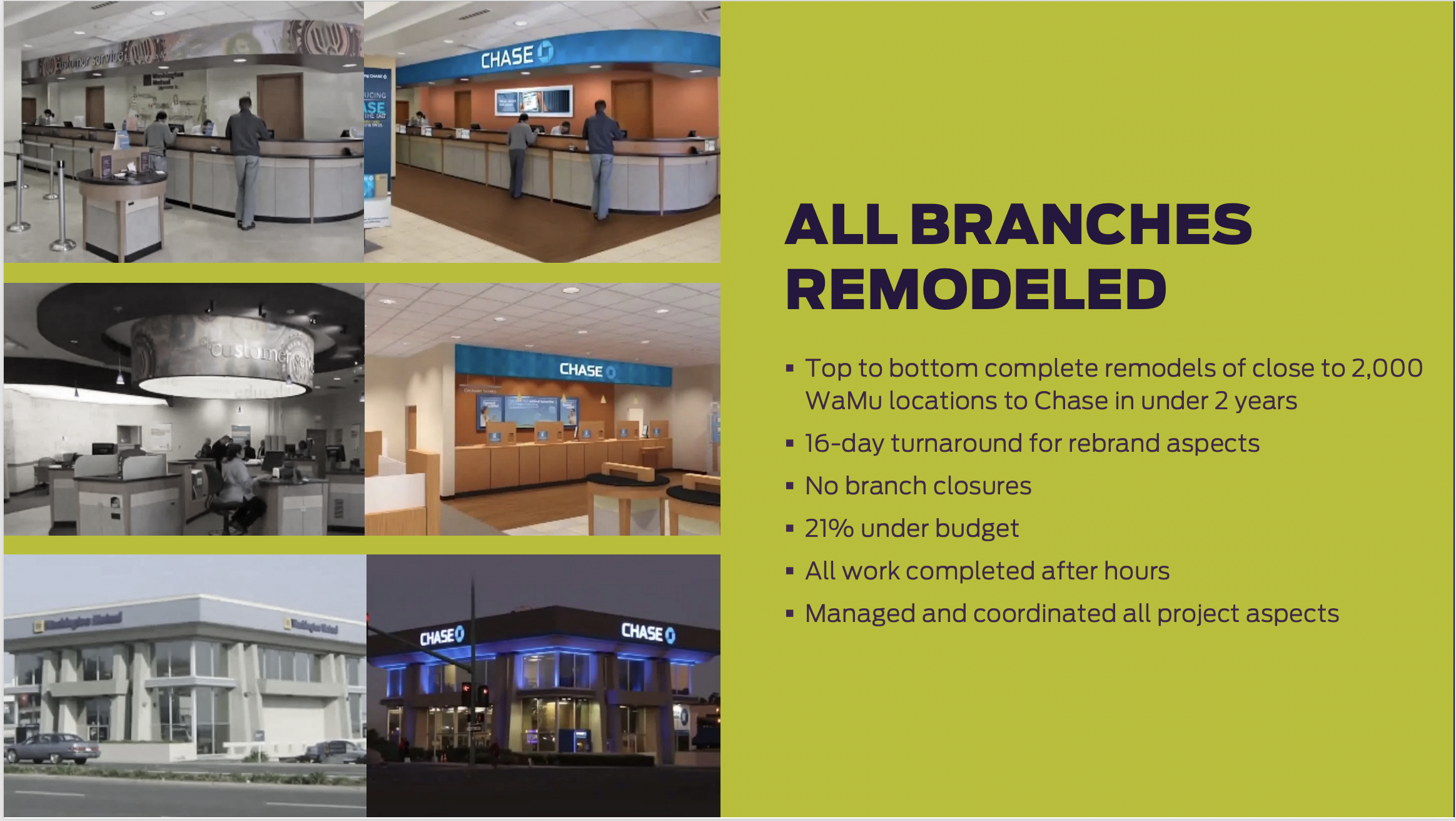

CHASE BANK

With $2.6 trillion in total assets and over 5000 branches, JPMorgan Chase is the largest bank in the US and a long-time DBSI customer. One of the largest projects in our firm's history together included a massive, large-scale conversion of nearly 2000 Washington Mutual sites. Brand change with speed was the objective and challenge all wrapped up into one. Through immense upfront planning, DBSI was able to get the branch remodel/conversion process down to a mere 21-days from start to finish! By having DBSI handle all aspects (permitting, engineering, drawings, fabrication, banking technology, property management, and installation), the schedule was orchestrated flawlessly and fast.

With $2.6 trillion in total assets and over 5000 branches, JPMorgan Chase is the largest bank in the US and a long-time DBSI customer. One of the largest projects in our firm's history together included a massive, large-scale conversion of nearly 2000 Washington Mutual sites. Brand change with speed was the objective and challenge all wrapped up into one. Through immense upfront planning, DBSI was able to get the branch remodel/conversion process down to a mere 21-days from start to finish! By having DBSI handle all aspects (permitting, engineering, drawings, fabrication, banking technology, property management, and installation), the schedule was orchestrated flawlessly and fast.

One of the secrets for managing such a massive project?

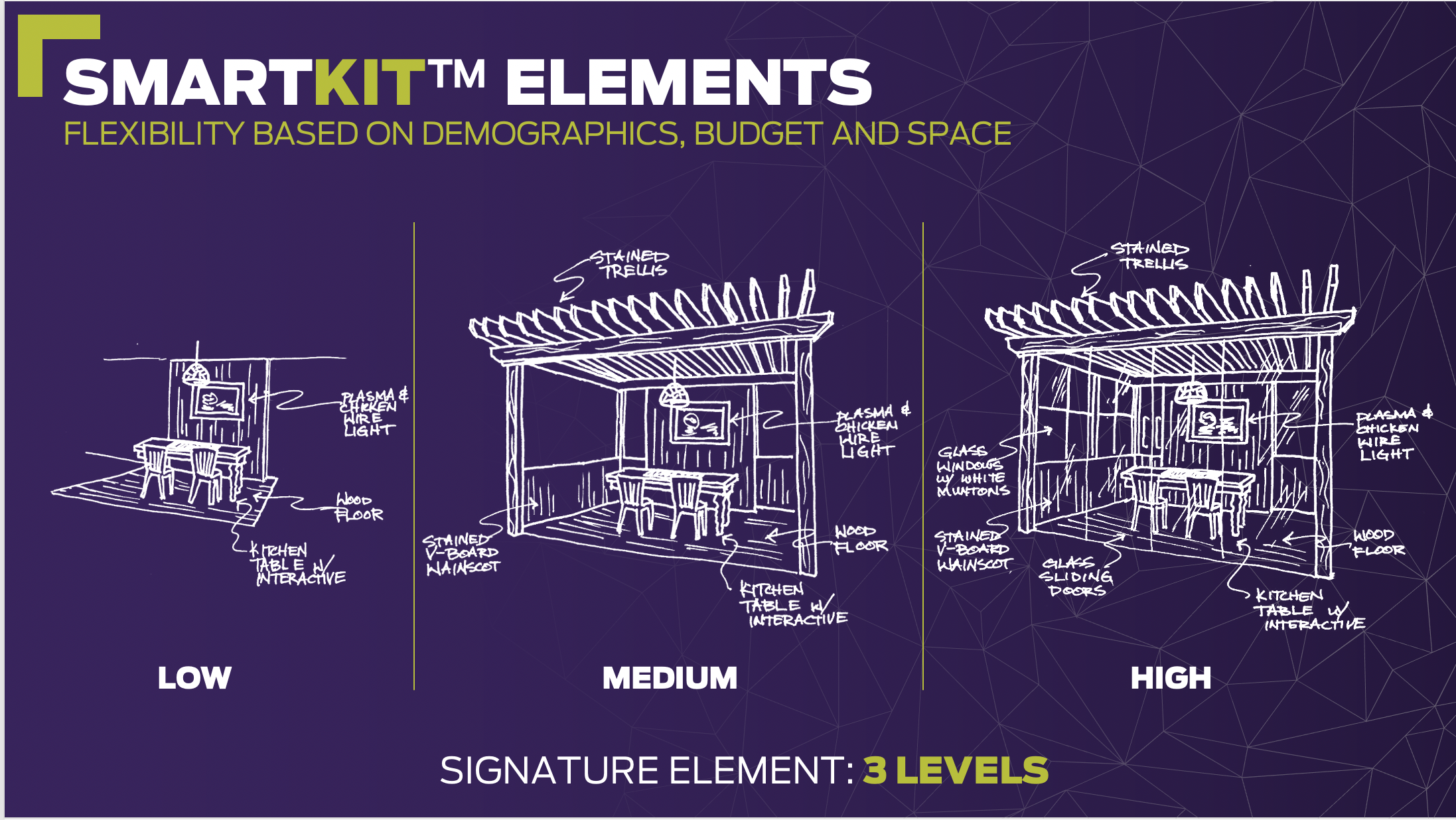

Apply a defined strategy and Kit of Parts across different investment levels

When doing a large-scale conversion, or really any branch network-wide updates, the first step should be creating a set Kit of Parts for different branch segments and investment levels prior to doing any scheduling or actual work. These Smart Kit packages should be based on branch objectives, market potential, and of course, overall budget. Then, these applications can be packaged and mass applied to relevant branches. Each location now has a set strategy, plus consistency and economies of scale are achieved through in a strategic rollout plan versus one-offs.

CHASE PRIVATE CLIENT

While not technically a M&A project, the Chase Private Client initiative was similar in the sense that 1,200 branch locations needed to be retrofitted to an upscale experience that catered to a high net-worth/wealth market opportunity. One of the key secrets to making this a success was once again all about the planning stages.

While not technically a M&A project, the Chase Private Client initiative was similar in the sense that 1,200 branch locations needed to be retrofitted to an upscale experience that catered to a high net-worth/wealth market opportunity. One of the key secrets to making this a success was once again all about the planning stages.

Test Concepts Before Mass Roll Out

Before investing millions of dollars into new concepts and ideas, having the ability to test things out and make tweaks can pay big dividends in the long run. DBSI's Collaboratory is created just for this purpose and proved to be a massive cost savings for the Chase project. In this "secret lab" we were able to take concepts, refine them over a short period of time, and roll-out this program effectively across 1,200 plus locations

Create a Signature Element for Branch Consistency

Another secret seen with the Chase Private Client initiative that works wonders for bringing together a patchwork of branches following an M&A is having a signature element implemented in each location. This signature elements easily brings a consistent branding feature, and can even have different levels of implementation based on demographics, budget and space. The example below showcases a signature element of a Community Room that creates differentiation for this particular brand, and has a detailed plan for how it will be executed at multiple levels.

Of course, there are million other parts and pieces that go into a merger or acquisition branch conversion project, but these strategies are a great place to start if you are in the beginning phases. Another helpful tool created from our past experiences and works in these projects is this helpful M&A checklist. Download it here!

Emily Sweillam

Emily Sweillam

-1.png)

-4.png)