You've seen Oprah's Favorite things and countless other lists of things to buy as gifts but aren't you forgetting someone... What's on your client's wish list from their primary financial institution? It may not be the latest version of headphones or fluffy socks, but consumer needs have changed A LOT this year, so we made a list and checked it twice!

1. Deck the Halls with Digital Banking Options

If this isn't on your 2021 budget, halt the presses! More consumers than ever before are using mobile and digital services for everything to food delivery, to checking toilet paper stock at the grocery store.  Onboard the remaining clients to mobile banking options with some help from digital signage and universal associates. Interactive digital signage kiosks can help clients onboard themselves or work as a tool for universal associates to help clients while in the branch.

Onboard the remaining clients to mobile banking options with some help from digital signage and universal associates. Interactive digital signage kiosks can help clients onboard themselves or work as a tool for universal associates to help clients while in the branch.

Almost 60% of people who encounter digital signage want to learn more about the advertised topic, which makes it more important than ever that branches with digital signage also offer interactive kiosks. With interactive displays, clients can explore everything that a financial institution has to offer including digital brochures and apps.

Attract future clients with digital tools such as Financial HealthCheck. Financial HealthCheck is an online application that helps clients self-assess key financial indicators in just 90 seconds, generating an instant report of how they’re doing financially and where they stand against their peers. With every submission, you’ll learn more about your client’s unique financial needs and everything else you need to help guide relevant advisory conversations.

2. An Expert Under the Tree

Or anywhere that in convenient for your clients. Access to experts is really important to clients especially now that low-value transactions are moving to digital or self-service channels, experts need to be available for more advanced conversations and questions.

Expert nearby is the perfect way to accomplish this goal. Rather than have experts on staff at every location or necessitate travel from branch to branch, ‘Expert Nearby’ provides a two-way video conference solution, giving members immediate access to experts. This technology can easily be used as a telebanking option allowing your clients to speak with experts, sign documents, and make big financial decisions from the comfort of their own home.

3. Over the River and Through the Woods to [Insert Your Financial Institution's Name Here] Branch We Go!

While there is a significant increase in digital banking usage, Forrester research predicts Banks shouldn’t abandon the branch but instead refocus it to drive customer and employee engagement. Before COVID-19, withdrawing and depositing cash was the to p activity U.S. online adults did in a bank branch. As digital payments become the norm, predictions state that the branch will become a place for meaningful conversations about clients’ financial well-being.

p activity U.S. online adults did in a bank branch. As digital payments become the norm, predictions state that the branch will become a place for meaningful conversations about clients’ financial well-being.

The branch of the future is able to adapt to a changing landscape at the drop of a hat. Deliver your brand experience no matter what is going on outside your doors with ADAPTIV--a flexible kit of parts that can be applied to any branch, new or established. Packed with tons of choices to make your branch ready to tackle all of the trends and challenges for 2021.

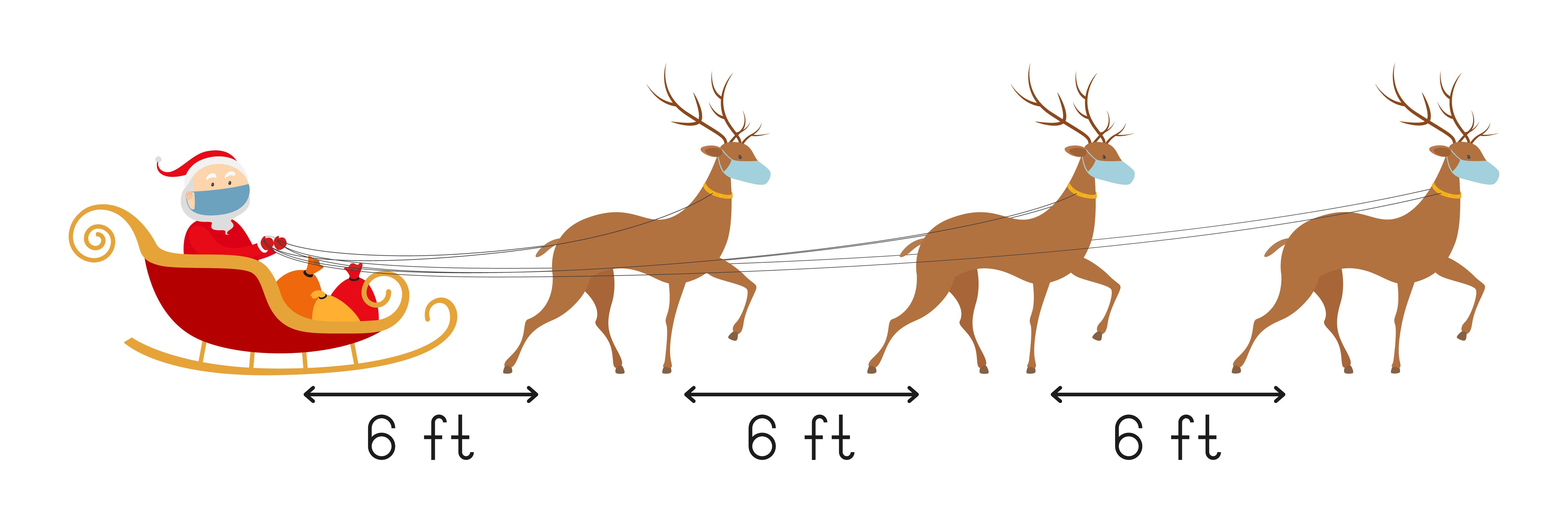

4. Keep your Claus Off That!

Touchless or low-touch branch experience is a must-have for most consumers. Even if they are looking for some human interaction and want to come into the branch to complete simple transactions, we are all much more aware of germs and frequently touched surfaces. Technology that is easy to clean like interactive kiosks. Self-service options, like NEXT, can cut down on person to person interactions for low-value transactions.

As we get closer to the 1-year mark of this pandemic fatigue is setting in on all of us. Use secret shoppers and training session to make sure your associates are staying on top of all the great processes you developed for in-branch safety.

5. Good Tidings and an Exceptional Experience

Your competition is constantly innovating so that means you have to be the exception to beat them. Your in-branch experience has to rival even the best retail giants and deliver on client's expectation that your branch is filled with experts ready to help them reach their financial goals. Your digital experience is just as important especially right now. Highly personalized experiences are expected from consumers, but 75% of financial institutions considered themselves ‘not adept’ and using data and analytics to determine a next best action (Digital Banking Report). Despite this performance gap, the accelerated growth in predictive personalization will be a key digital transformation trend for success in 2021.

So, how do you accomplish this heightened experience? Well-trained Universal Associates. Even if you believe your associates are great and already operating on the Universal Associate Model, great training is an ongoing project. Just like a chef must keep knives sharp you must keep your associates sharp and ready to help your clients.

As a financial institution you have done a lot for your clients already this year. Branch closures, local mandates, small business loans, having to develop digital channels overnight, and so much more. But as a Financial Institution you also know you would do anything for your clients and wouldn't have it any other way. Thank you for being an essential part of your community!

Emily Sweillam

Emily Sweillam

-1.png)

-4.png)