2 min read

Transforming the Client Experience with Remote Transaction Assist

Elise Roling : Updated on February 14, 2021

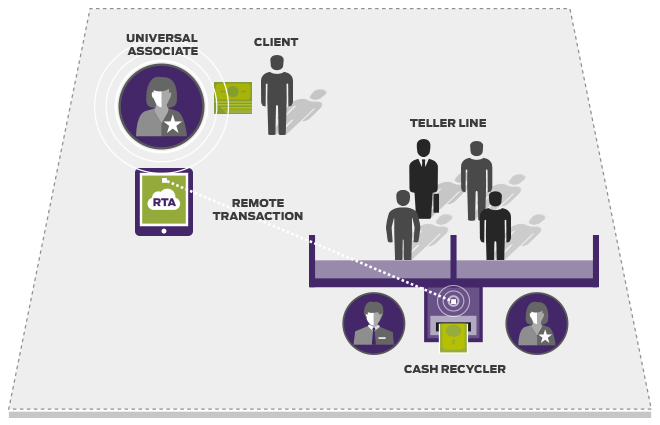

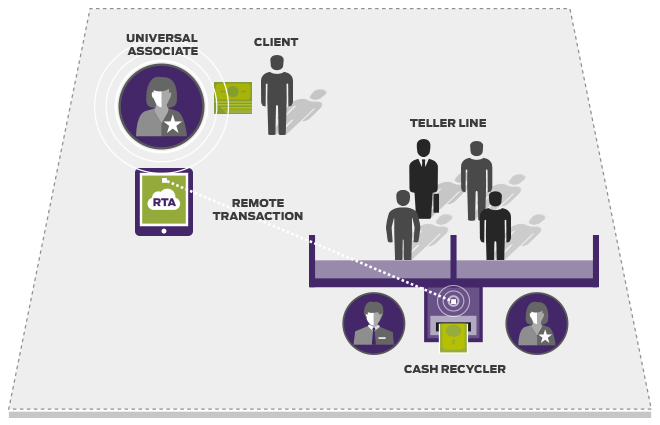

You're traveling through another dimension, a dimension where your associates are no longer handcuffed behind the teller line and your cash dispensers and recyclers are available to all of your service representatives. A journey into a wondrous land of Universal Associates, open branch floor plans and a superior client experience.

Your next stop—Remote Transaction Assist by CFM.

It may sound like a dream world, but CFM has broken the traditional banking technology mold (again) with RTA (known as RiTA around these parts). We recognized that the associate/client experience can be…well, pretty darn clunky and not customer-focused sometimes, so we worked our behind the scenes magic and crafted a ground-up solution that allows tellers and associates the ability to move throughout the branch and process transactions from just about anywhere.

Yes, you read that right…we said anywhere.

To give you an example of how RTA can shine in your branch, let’s say that one of your clients just opened a new account and now they are interested in depositing some cash into that same account. Right now, your associates have limited choices that include breaking contact with that client for an extended period of time, disrupting other clients by cutting in line to work with a teller, or even worse, going behind the teller line and disrupting a teller to process their transaction. This traditional method of doing business creates a poor experience—for both the client that just opened account and the rest of the clients in that branch.

How much of a game changer would it be for your branch if that same deposit could be completed in less time and without having to leave the client or disrupting other customers? With RTA, the same transaction can now be totally, completely, 100% remote and on your schedule…your machine is no longer in charge of the timing. Your associates and tellers can begin the withdrawal or deposit process by sending the request on a staff member’s workstation on any device, then at their convenience, the transaction is processed at the dispenser or recycler using a short, unique code. Once the associate is finished at the cash machine, they can head back to their work area and complete the transaction with the customer.

BOOM—deposits or withdrawals on demand!

We believe that RTA is a revolutionary way to utilize your cash handling technology, and we’re betting that you will agree. RTA lets you do more with less hardware—giving everyone in your branch access to your hardware and building the path to open branch designs and Universal Associates. If improving the client experience and increasing staff efficiency matters to you, get in touch with CFM now to discuss how RTA can benefit your organization.

-1.png)

-4.png)