2 min read

Which Transformation Trends Are On Deck for Financial Institutions in 2019?

Bruce Allen Eastwood : Updated on February 14, 2021

The World Series is officially underway, which means baseball is winding down until Spring Training. Whether you're a die-hard fan of America's favorite pastime, just enjoy Ballpark hot dogs, or fall anywhere in between, we're all bankers—and in our world, there's no such thing as an off-season.

Unlike the MLB, we approach every day like it's game day. Okay, so our branches observe standard business hours instead of random schedules, and the closest thing we have to extra innings is 24/7 online banking. We count cash instead of pitches, and prefer transactions and technology over bats and balls—but don't count us out as athletes just yet. We're major players in a brand new, year-round ball game: Branch Transformation.

This shouldn't come out of left field. Financial institutions are under more pressure than ever to transform—which means keeping up with more moving parts than statisticians can track and cutting through the noise around which trends will move us closer to a transformation win.

It's tempting to take on the latest fads to remain relevant or create a buzz in the branch, but we all know there's no "one-size-fits-all" solution for a successful Branch Transformation (our industry's version of winning the World Series).

How can we separate which trends will strike out from the grand slams when there's so many different market needs to solve for?

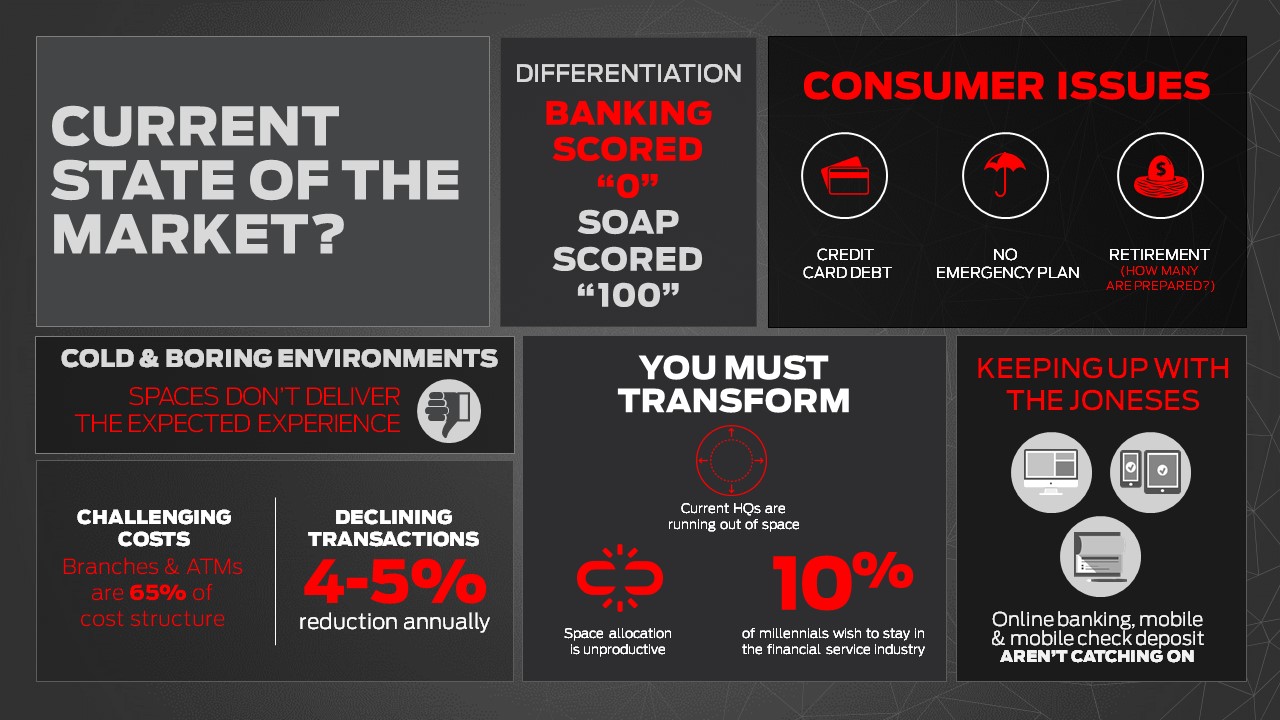

Before you determine what's right for your future branches, you have to pinpoint your network's "why" behind playing the game—your current state—before you identify which trends will deliver your intended outcome.

With an average credit card debt of $15,270 and 63% of consumers without any emergency savings plans, you'd think your clients would be racing to the branch to get some help on achieving their financial hopes, dreams, and aspirations...right?

Unfortunately, it's not happening—but why?

Could it be because of a stale, outdated environment? Or the declining number of transactions and overall branch traffic? With fewer branch visitors, how does your staff maximize their opportunities to advise clients to relevant products face-to-face? Can clients expect guidance in adopting more convenient ways to bank with you—or are you relying on brochures to show them how? Do you provide multiple ways for them to truly discover and learn the products you offer to help them through life's journey—or will they achieve their financial goals and aspirations with a competitor? And if they do bank with a competitor, are you effectively communicating your differentiation, reminding them of what it means to bank with you?

Regardless of which of these hit home for your financial institution, it's clear that the season is far from over and the market has some work to do to better meet client needs. That said, the journey ahead hasn't held anyone back from making significant strides to improve the branch experience, including integrating and implementing trends in their transformation strategies.

Unless you're standing on the pitcher's mound, no one appreciates a curve ball (especially when it comes to projects of this size and importance!). If you want to know which transformation trends are successfully catching on across the league (instead of relying on feedback from the bleachers), check out the infographic below to get coached up on what financial institutions are investing in now!

Are any of these trends on deck for your branch transformation? Feeling the heat from your efforts so far and need a relief pitcher? Want to experience these trends along with the top ideas, technology, and strategies changing retail banking...with a side of Spring Training in Arizona? Put us in, coach! We'd love the chance to step up to the plate for you.

-1.png)

-4.png)