4 min read

Why Every Bit Matters When Building Your Branch Transformation Budget

Corde Kurtz

:

August 21, 2023

Corde Kurtz

:

August 21, 2023

.jpg)

As budgeting season approaches, it’s time to start thinking about what goals you have for your financial institution (FI) in the following year. A few questions:

- Are you planning a branch remodel?

- Is a new branch or micro-branch in your FI’s future?

- Are you planning a headquarters remodel or build?

Here at DBSI, we know how important every step of the branch transformation journey is, and our goal is to keep our clients fully informed throughout. From pulling historical data on previous projects to comparing cost averages from bankography and other contractors, we start by providing our clients with accurate budget totals that reflect current market conditions.

As each project progresses, we then monitor budgets across the design, engineering, and construction phases until final results are achieved. Along the way, we also make sure every FI is aware of any changes to scope and timelines—as we believe transparency and open communication are vital to the success of any transformation.

Reasons Your Financial Institution Needs a Branch Transformation Budget

When you’re going through the phases of a branch transformation, the last thing you want to do is surprise your stakeholders and board with unplanned variables. That said, here are some of the top reasons building a branch transformation budget is so important:

- You can manage costs and avoid overspending. A branch transformation budget will provide a big picture snapshot of the expenses associated with a construction project. All aspects are outlined—from labor, materials, and equipment to permits, fees, and contingencies.

- It helps you make more informed decisions. When all options are mapped out on a branch transformation budget, it’s easier for your FI to identify and manage potential risks and roadblocks associated with design and construction. Not only that, but the scope of the project is shared with all stakeholders so that parameters are clear and expectations are understood.

- You’re aware of the project’s timeline. A realistic branch transformation budget will incorporate project timelines based on resources and contingencies. As long as these factors are accounted for, interruptions to schedules, delayed service, and unnecessary contractor hours can be avoided.

Considerations For Building a Branch Transformation Budget

In order to develop a working budget, you first need to answer questions critical to your construction project, and by answering these questions you will lay the groundwork for putting numbers together.

What type of build are you planning?

When it comes to a transformation, there are usually four types of build options, each with their own level of cost and difficulty. The type of build you choose will have the biggest influence on your overall budget, other than size and location of your build. If you’re not sure which one will bring maximum return on investment (ROI) for your FI, then utilizing DBSI’s 6d® discovery process can help you make that decision.

have the biggest influence on your overall budget, other than size and location of your build. If you’re not sure which one will bring maximum return on investment (ROI) for your FI, then utilizing DBSI’s 6d® discovery process can help you make that decision.

In general, the options are:

- Branch remodel or renovation

- New-build Ground Up

- Headquarters transformation

- Micro-branch build

Benchmarking data from thousands of completed DBSI design-build projects suggests that a new build will typically cost 50% more than a remodel.

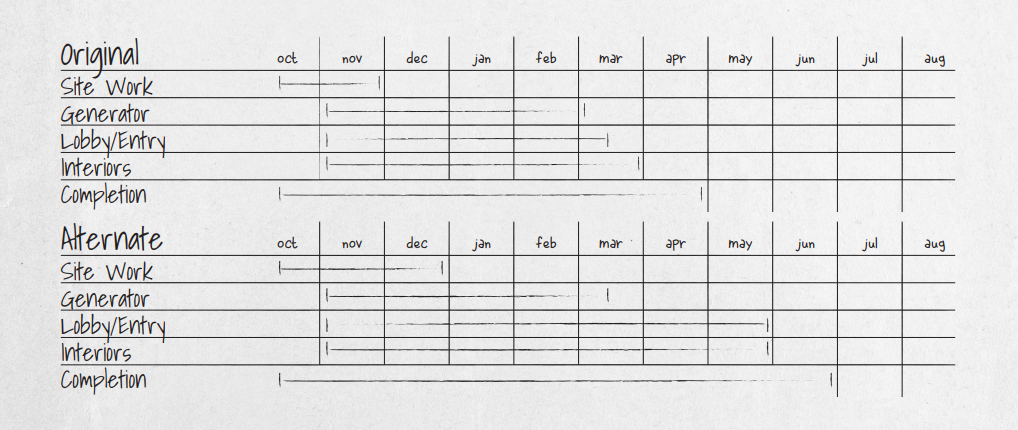

What is your timeline and delivery date for this branch transformation

Your project’s build and final delivery dates will vary slightly depending on the type of construction process you choose, whether it’s a design-build or design-bid-build. Overall, design-bid-build has been known to take longer since you have to work with designers and construction contractors separately—and multiple ones at that.

As you plan dates, remember to create an alternative timeline, and be prepared in the event of supply chain bottlenecks or build issues.

What size of build are you planning?

The square footage you need for your project is primarily determined by the type of build you’re planning, however, your overall strategy, desired client experience, and expected outcomes all play a role in the total square footage needed. Here’s an average outline on size:

- Under 1,500 sq ft = Micro-project

- 2,000-3,000 sq ft = Small project

- 3,000-4,000 sq ft = Medium project

- 4,000-6,000 sq ft = Large project

Recent industry reports show that the branch footprint is approximately 2,500 sq ft on a new build.

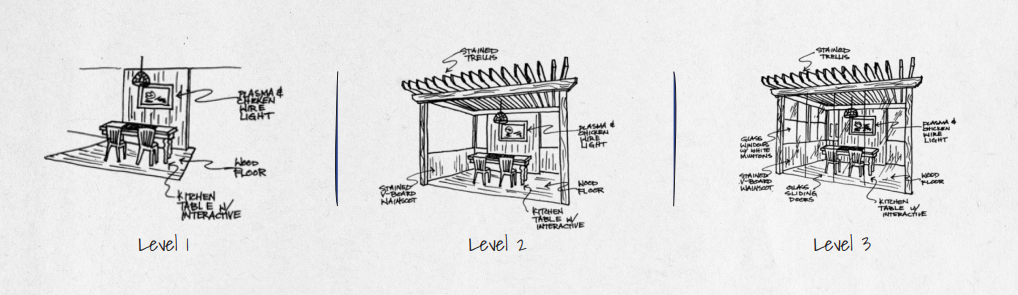

What finish is needed for this branch transformation?

At DBSI, we have three different levels to determine the physical finish of your build, and the one you select will directly impact your budget. Of course, the amount of square footage comes into consideration here as does the type and availability of materials.

Aside from a budget, you’re going to want to consider demographics, your target market, branch traffic, and overall budget when choosing your finish.

What technology is needed for this branch transformation?

With transaction volume lowering in recent years and types of transactions changing inside branch locations, it makes sense to align branch network functions differently. In this respect, there are now opportunities to restructure branches with a more customer-centric focus and create flexible spaces with equipment and technology that aid in advisory-level conversations and services.

Here are equipment and technology options you may want to consider:

- Teller cash recyclers (TCRs)

- Self-service solutions (ITMs, ATMs, Interactive Kiosks)

- Tablet banking

- Digital signage

- Core integration

- Mobile banking

- Video banking

A 2023 Zendesk Customer Experience Trends Report noted that 62% of business customers think their experiences should flow naturally between both physical and digital spaces.

Building Your Branch Transformation Budget

Once you’ve identified all the details of your build—you can develop a project plan—also known in the construction industry as a scope of work (SOW). Here, you will make a list of everything that needs to be accounted for and how much it will cost; just make sure you are detailed, accurate, and thorough on each line item to avoid surprise budget additions later.

These are the six components of an SOW:

- Demolition (if needed) and construction

- Design, architecture, interior design, engineering

- Banking equipment, technology, etc.

- Branding, digital signage, and merchandising

- Owner-provided items, IT, office supplies, etc.

- Contingency, unforeseen circumstances, and change

When your SOW is finished, it’s time to add everything up to get an estimated total on what your project’s budget will be. If you need assistance with this process, DBSI has a budgeting tool that can help you determine the numbers correctly.

For even more great insights on building a branch transformation budget, get our DBSI Budget Season Guide here.

Ready to Get Started With Your Branch Transformation?

Understandably, developing a branch transformation budget takes a lot of time, research, and often—patience. But after thousands of directing new builds and remodels, we at DBSI have a defined process for helping FIs like yours build budgets that get approved.

To get started, ask us about our Executive Strategy Sessions, which can help you build a branch transformation budget and learn how to pitch it to your board. If you’d like, we can also present the budget to the board on your behalf.

Together, let's bring the vision for your future to life!

Through DBSI’s carefully curated professional service programs, we can help shift your staff’s culture, processes, job descriptions, and so much more.

-1.png?width=477&height=286&name=MicrosoftTeams-image%20(50)-1.png)

-1.png)

-4.png)