4 min read

Why Cash Automation is Key to Your Financial Institution’s Success

.png) Amanda Farmer

:

Updated on October 18, 2023

Amanda Farmer

:

Updated on October 18, 2023

Adding cash automation machines to your branch network helps increase operational efficiency and accuracy in addition to promoting better service and fraud protection.

Today, most people have technology right at their fingertips, and as a result, they expect better experiences from the businesses they patronize. When it comes to banking, this means clients want faster service, more knowledgeable staff, and the assurance that their transactions and funds are always safe.

What’s a way to provide these experiences then, especially with online and mobile banking commanding bigger shares of the market each year?

By adding cash automation technology to your branch network!

For 25 years, our experts at DBSI have been assisting financial institutions in finding the cash automation equipment that best fits their network needs and servicing that equipment to keep it running smoothly across its lifecycle.

What Is Cash Automation in Banking?

Until the last decade or so, much of the banking industry has relied on manual cash handling processes to perform daily banking activities like deposits, withdrawals, and transfers. Overall, this work tends to be cumbersome, time-consuming, and inefficient—not to mention—costly.

Cash automation, on the other hand, is technology that uses machines to manage different denominations of currency in order to reduce the manual labor involved in the process and improve accuracy.

Find out more about cash automation technology in this free DBSI Product Guide.

What Is a Teller Cash Recycler (TCR)?

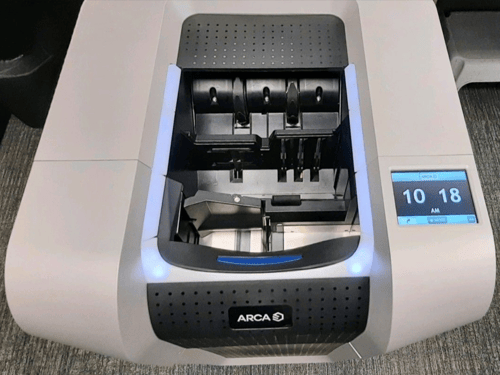

A TCR is a machine that automates the cash cycle by accepting, counting, sorting, and dispensing notes and coins; it’s most commonly seen in retail banking environments but is also used in industries like grocery, hospitality, gaming, and entertainment.

When cash is deposited into the recycler, the machine automatically calculates the total, records the deposit, and stores it securely. When cash is withdrawn, the recycler automatically dispenses the currency and records the total amount of withdrawal.

Besides authenticating notes and coins, this advanced machine performs vault transactions and can provide staff with automated cash audits. It’s increasingly popular across banking networks, and according to CFM, now Kinective, at least 75% of the banking industry is leveraging TCRs in their branch locations.

Learn everything you need to know about Teller Cash Recyclers in this DBSI TCR Guide.

How Can a TCR Benefit a Financial Institution?

Although credit card payments and digital payments are gaining wider use among consumers, the Federal Reserve of San Francisco found in a survey that 18% of all payments are still made with cash—which gives continued relevance to the need for better technology in handling currency.

Here are some ways a TCR improves the branch:

Increased Transaction Efficiency

Manual cash handling in the retail banking environment is both time consuming and costly. Without a TCR, a teller or associate must spend a significant amount of time doing start-of-day, deposits, withdrawals, end-of-day, and other important banking functions.

With a TCR in place, a branch associate gains 12-18% in availability for client transactions, according to industry averages. This additional time can be used to develop the client-associate relationship, cross-sell products, and serve other needs in the branch.

Besides cash handling, TCRs change the nature of vault transactions since they automatically count, verify, and store branch cash. This capability eliminates the need for dual-person authentications, saving 10-15 minutes of balancing time and simplifying verification and settlement processes.

Cash recyclers speed up banking transactions, improving staff productivity by 40% (ARCA).

Higher Accuracy

When it comes to manual banking transactions, human error accounts for most (if not all) discrepancies. This is not only stressful for staff members who typically must complete tasks within designated time frames, but it’s stressful for managers who are responsible for accurate reporting.

On the other hand, TCRs are able to automate transactions and increase accuracy up to 100%, therefore eliminating imbalances on the general ledger. As a result, it becomes easier to forecast cash flow accurately and make better business decisions about branch operations.

Improved Security

Historically, manual cash handling has required associates to move cash a number of times each day between teller drawers and the vault. This activity not only increases the potential for mistakes but puts the branch at a higher risk of fraud and theft with all the added exposure. After implementing TCRs, however, daily vault activity can virtually be eliminated since TCRs store cash safely 24-7.

Teller Cash Recyclers can also communicate directly with a financial institution’s alarm system, in the event of a robbery. Additionally, the TCR can be programmed to dispense a pre-set amount of cash without exposing all the cash inventory—an action that could get a thief out of the branch office or buy time until the police arrive.

61% of TCR users were able to eliminate vault activities after implementing TCRs. (Kinective)

Easier Transition to the Universal Associate Model

Moving from a traditional operating model with tellers to an advisory-based model with Universal Associates involves elimination of the teller counter and conversion to an open-branch design. It also involves pairing TCRs with centralized workstations or service locations and streamlining core technology to facilitate all transactions.

Once this new floor plan is implemented, Universal Associates are able to operate from workstations paired with TCRs and cross between them whenever necessary. Overall, staffing decisions become easier since no drawer change outs are needed at shift change and associates are cross trained on most daily banking activities.

THINGS TO CONSIDER BEFORE ADDING TCRS to YOUR network:

Although TCRs have a lot of benefits, they also come with a few challenges, including some of the following:

- Acquiring TCRs involves a degree of up-front capital, so it’s important to determine your return on investment (ROI) before making any purchase decisions.

- You will need to train your staff how to use TCRs, and if you’re also implementing a Universal Associate Model, make sure you add TCR training to the overall training sequence.

- TCRs require routine maintenance, which should always be completed by trained equipment experts such as the service technicians at DBSI.

Automate Your Financial Institution’s Future with TCRs

Overall, TCRs help your branches operate more efficiently so your associates can focus on more advisory conversations instead of spending time counting cash and changing out teller drawers. TCRs also promote 100% accuracy and assure a more secure environment for associates and clients alike.

For more information about cash automation equipment, its costs, and service requirements, please contact DBSI by filling out our online form or calling us at 844-777-5457.

Together, let's bring the vision for your future to life!

-1.png)

-4.png)