4 min read

When ‘Social Distancing’ Becomes ‘Distance Banking’

Emily Sweillam

:

Updated on December 17, 2020

Emily Sweillam

:

Updated on December 17, 2020

With the Coronavirus making its way around the world, everything is either shutting down or finding new ways to operate. And as an essential business, your financial institution is being pushed to the limits. You are certainly running 1,000 mph and it can be hard to imagine starting a new project or focusing on anything but the current situation at hand. We get it.

That’s why we've taken the research part for you and covering a few ways you can plan to change your branch for the future—for the post-COVID-19 era of client expectations.

The biggest driver behind your need to change will be ‘social-distancing.’ People are becoming more accustomed to maintaining a 6-feet space between themselves and others, and that behavior won’t just disappear because the Coronavirus is no longer forcing a quarantine. For months, maybe even years, this behavior will continue and it is your job as a retail and essential establishment to make their banking environment a comfortable one.

One of the first places to start: the layout of the branch. A few ways you can ensure your branches are prepared for the future...

Open Up Your Teller Lines

Queue ropes force people to stand near one another. Teller windows, on average, offer only two feet of space between one client and the next. Transform them and the amount of space you provide clients with Teller Towers.

What are Teller Towers?

A retail-friendly twist on the old-school teller line, Teller Towers remove the barriers and cold transactions traditionally seen in branches and replaces the line with inviting, tactical towers that can service two clients at a time with complete privacy and convenience. In fact, there is on average 6 feet between the two clients when standing at a tower—perfect for social distancing. They also eliminate the queue line and allow for clients to stand where they feel comfortable while they wait for their preferred associate to become available.

Keep Office Use to a Minimum

Opt out of hosting advisory interactions in confining and small-office spaces and instead open the environment with flexible working spaces that still offer privacy and security, like Service Spots.

What are Service Spots?

A new take on the typical office, desk, and cubicle usually found in financial institutions, Service Spot is a modern way for personal bankers and services representatives to have one-on-one meetings with clients. Created with clients in mind, the focus is on a more accessible, collaborative atmosphere to provide private banking consultations. Meant to be placed out in the open within the main area of the bank or credit union, the Service Spot is unencumbered by cubicle walls, windows, or even an imposing desk. Instead, it's a modular, self-contained space, featuring a café table and stools, plus a swivel monitor against its sidewall for account communications with clients.

Minimize Human Interactions

The concept creates an inviting, more casual and collaborative atmosphere between bankers and their clients. Sound-deadening material ensures that conversations stay private. And, placing an array of Service Spot desks in a financial institution creates more space and privacy than ever before–because they can be distanced further apart than a standard cubicle layout.

On the path of limiting unnecessary human interaction, there are two technologies you can adopt that will allow for a client to complete all of their banking needs with one associate or less. First, is a self-service machine on steroids known as NEXT which will allow clients to complete most of the transactions they need without interacting with a single human. The other is Nomadix, a tablet-based teller platform, which eliminates the need for both tellers and bankers and enables the Universal Associate Model.

What is NEXT?

NEXT® is a self-service experience that delivers more transaction options to clients and more support to associates than any other self-service technology. A client can come into the branch, log in to their account, and complete every transaction a teller could for them, including cashiers checks and withdrawal down to the penny. And if mid-transaction they realize they want to do something more, an associate can easily switch the in-progress transaction to their tablet and continue the conversation in a flex space, like a Service Spot.

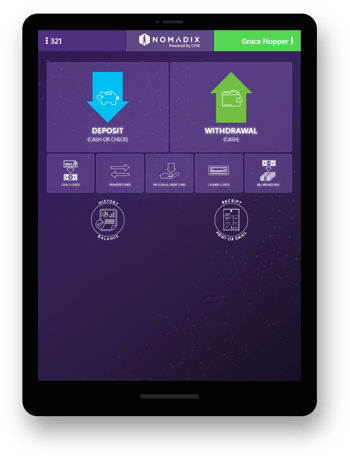

What is Nomadix?

This CFM innovation places teller capabilities into the hands of associates. Using queuing technology, Nomadix allows associates to move throughout the branch and process transactions from just about anywhere. It’s a game-changing tool that drives the future of retail banking. The goal is to allow associates to offer a fluid client experience by making both the teller platform and cash recyclers available to everyone—from any spot in the branch. Now, whether associates are standing right next to a cash machine, working at Service Spot, or greeting someone in the lobby, their clients can be served from start to finish.

Allow for Virtual Visits with Experts

Having every type of banking expert in every one of your branches is not possible and your clients get it, especially after this crisis passes. But their need for those experts will not change (in fact they may increase), so it is important you do your best to provide them with those services in an easy and convenient manner. The best way to do that is with an Expert Nearby station.

What is Expert Nearby?

A private area or room in your branch where a client can meet with any type of expert in a human-less, virtual environment. And it benefits the experts too, increasing their client interactions and decreasing their need to travel.

Some of the biggest advantages of Expert Nearby include the ability to:

- Provide a virtual environment for ‘socially-distanced’ interactions

- Connect an entire branch network of experts

- Offer full service at all branch locations

- Improve client experience

- Reduce travel and branch staff costs

- Increase the number of client interactions

- Increase revenue by reducing “walk away” losses

So...Whether you are focused on what to do now, what is coming in the near and far future, or something else, all of us at DBSI + CFM are here to support you and your clients.

This is the second blog in an 8-part series.

- Read part 1 here: "How Financial Institutions Can Survive (& Thrive) During COVID-19"

- Read part 3 here:"A New Standard for Community Involvement."

- Read part 4 here: "How To Take Maximum Advantage of Empty Branches."

- Read part 5 here: "A Quick and Easy Way Banks and Credit Unions Can Cut Costs."

- Read part 6 here: "Ideas for Communicating with Clients."

- Part 7 will be released 04/30/20!

-1.png)

-4.png)