6 min read

How Financial Institutions Can Survive and Thrive Through the COVID-19 Pandemic

Emily Sweillam

:

Updated on December 17, 2020

Emily Sweillam

:

Updated on December 17, 2020

Just about everyone is shutting down to help stop the spread of the novel COVID-19. It's great to see the nation work together to try and contain this epidemic, but the effort is not going to be easy. Retail establishments are feeling the turbulence of this pandemic—including banks and credit unions. And financial institutions know better than anyone, with cultural turbulence like this, the economy will feel the same waves roll through it. As everyone does their part in trying to contain the spread of the virus, it is crucial for the economy that business continuity is upheld safely.

Thankfully, technology has made it easier than ever to maintain somewhat normal routines. Video conferencing, VPNs (Virtual Private Networks), and cloud-based software all make it possible for most office jobs to continue. Which got us thinking...how can banks and credit unions take their virtual client experience to the next level? So when this pandemic is over, we can thrive?

Here's our list of top recommendations for now and in the future to adapt to yet another changing landscape.

"Social Distancing" Banking

With the rise of the term "social distancing", it's time to hop on the bandwagon and embrace how you can incorporate this new norm into your branches and banking experience. A lot of branches are closing their lobbies and going to drive-thru only to keep clients and staff safe during this time. But, everyone still needs banking services, and in times of panic, people are looking for a reassuring person to talk to. Even more, once this shutdown starts to hit the economy, the demand for loans and funding will surely increase.

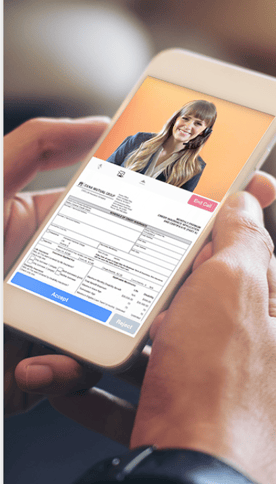

One way to help meet this demand and need is through video banking platforms. These platforms put face-to-face interactions in the palm of your clients' hands by allowing them to connect with a banker right from their phone. The latest technology is more than just a conversation—including capabilities to securely sign and share documents such as photo IDs, documents for new accounts, loans, and other urgent needs. This nearly creates nearly the same service a client could receive when visiting a branch!

While this type of technology previously felt like a luxury or bleeding-edge tech, it's becoming something banks and credit unions need to seriously consider adopting now. To help meet the current situational needs, DBSI is offering free video banking licenses through our partner, POPi/o. As a solution agnostic company, we only recommend what aligns to strategic intent, budget, and is proven in the market. We've vetted bunches of other video banking options, and this is the one we suggest. Even better, this is a solution that can be up and running in a few days because setup is not nearly as complicated as it may seem. Get more information by contacting us or joining a webinar demonstration on Tuesday, March 24th.

"Self-Isolation" Advisory Services

Now that more and more people are required (or opting) to shelter in place or self-isolate, the need for online financial tools is increasing. People are worried about their financial futures and desperately searching for advice. At the same time, a lot of people have extra time on their hands right now and looking for things to keep themselves busy.

This is the perfect moment to share any and all financial education, calculators, advisory services, etc. that you have to offer your clients. People are searching for answers and you can help.

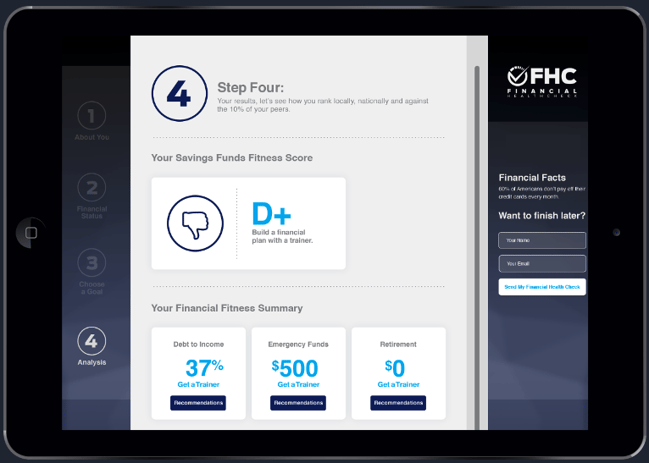

What if you could collect all the relevant client data you needed for warm advisory conversations, from anywhere, while offering a financial literacy tool at the same time? Financial HealthCheck (FHC), is another easy-to-adopt solution that is designed to do just that! Accessible anywhere online (i.e. from a couch or the comfort of home), people can self-asses their financial health in 90 seconds or less, see how they compare to their peers, be provided with more financial education on what their score means, and of course then have the option to speak with an advisor on how your products and services can help them. At the same time, you are receiving warm leads primed for your services. It's a perfect connection during these self-isolation times.

Additional benefits of FHC include:

- The acceleration of the client-associate interaction by allowing your staff to spend less time engaging in cold conversations and more time advising warm leads on products that they’ve already shown interest in.

- The ability to drive more people to the your financial institution or branch by demonstrating your ability to help them reach their expressed financial goals.

- A new way to gather a deeper understanding of where clients are on their financial journey and begin to identify trends and patterns that will help during strategic planning.

Take FHC for a test spin ad test your own financial health by clicking here.

Self-Service Options

Self-service is an obvious option to help ease the challenges of today's reality. ITMs, ATMs, and drive-thru technologies can easily be operated without having to be in close proximity to another individual. ITMs are also a great way to still have some face-to-face interaction and get all banking needs resolved without being in front an actual live person. The real challenge is trying to implement these solutions in new markets. When it comes to properly adopting self-service solutions, there are a lot of moving parts that need to be managed: from figuring out which tech is really right for your financial institution, to purchasing these often expensive machines, to creating a design that complements these technologies, to properly setting up staff to handle these back-office interactions, to training on handling actual transactions.

As a solution agnostic company, DBSI knows what works, what doesn't, and isn't afraid to give you unbiased information on how to move forward with self-service technologies. Even more than just tech, we get all the other moving pieces of implementing self-service and have all of the services in house. You could attempt to balance all these factors on your own, or even worse: you could hire multiple vendors to handle the multiple pieces of the project and cross your fingers they communicate well enough to independently put all the pieces of the puzzle together.

DBSI+CFM have seen it all and guided several financial institutions on in-branch self-service strategies with:

-

A process for understanding and answering key questions

-

A comparison of the pros and cons of self-service solutions available

-

How to decide which solution best aligns to strategy

-

Designs that complement this new service model

Rethinking Your Branch

This current situation truly can be a win-win for all. The win for is you taking advantage of closed or reduced foot traffic branches. This is a perfect time to take advantage and get to the refreshes or remodels you've been thinking about for a while. You won't be disrupting business, and work can be done faster with no distractions. The win for the community is you doing your part to help local businesses and keep the economy moving by using their services in a down time. Even better, you may be able to negotiate better pricing and get access to faster turnaround times as there isn't as much work in the queue. Truly a win-win!

Did you know...

- 47% of financial institutions plan to build fewer branches this coming year, 30% plan to build more branches, and 20% plan to keep their branch network the same. And of these, 81% of financial institutions plan to invest in a new design or branch model. (Efma/Synechron)

- When it comes to branch design, the top three goals a financial institution has are to come across as a trusted and secure institution (40%), appear as though they provide community collaboration (24%), and to provide a futuristic and digital-first environment (18%). (Efma/Synechron)

- 1 in 4 clients said they will not even consider a bank or credit union that doesn’t have a branch near them. (Biz Tech Magazine)

- Today, the average size of a new branch is about 2,500 square feet. (Independent Banker)

Use this branch report card to grade your branches and start thinking through some changes you can implement.

In-Branch Hygienic Marketing

Brochure racks are a great place for germs to hide and they are hard to clean without ruining the brochures. Digital signage and interactive digital signage are options that are easy to clean and update.

Also known as visual communications, digital signage displays take the world of signage to a new level by adding engaging content and screens to the branch experience. Kiosks or touchscreens allow clients to discover and browse through all your products and services, while staying clean!

Outside of being a hygienic solution, some other advantages of these digital signs include:

- Enhancing the experience

- Reducing perceived wait times

- Driving sales and influencing client behavior

- Delivering more effective advertising

- Making real-time updates based on audience, time of day, etc.

- Scheduling content in advance

- Lowering costs and reduce/remove static signage clutter

- Providing 52% higher recall rate

- Delivering a high-tech atmosphere

- Enhancing messaging with animation and sound

What do think? Have any more options you are considering that we missed? Feel free contact us and share your thoughts! Please stay safe and healthy during these times. See our CEO's letter addressing our company's efforts and how we are supporting our customers and staff.

This is the first blog in an 8-part series.

- Read part 2 here: "When Social-Distancing Becomes Distance Banking."

- Read part 3 here:"A New Standard for Community Involvement."

- Read part 4 here: "How To Take Maximum Advantage of Empty Branches."

- Read part 5 here: "A Quick and Easy Way Banks and Credit Unions Can Cut Costs."

- Read part 6 here: "Ideas for Communicating with Clients."

- Part 7 will be released 04/30/20!

-1.png)

-4.png)